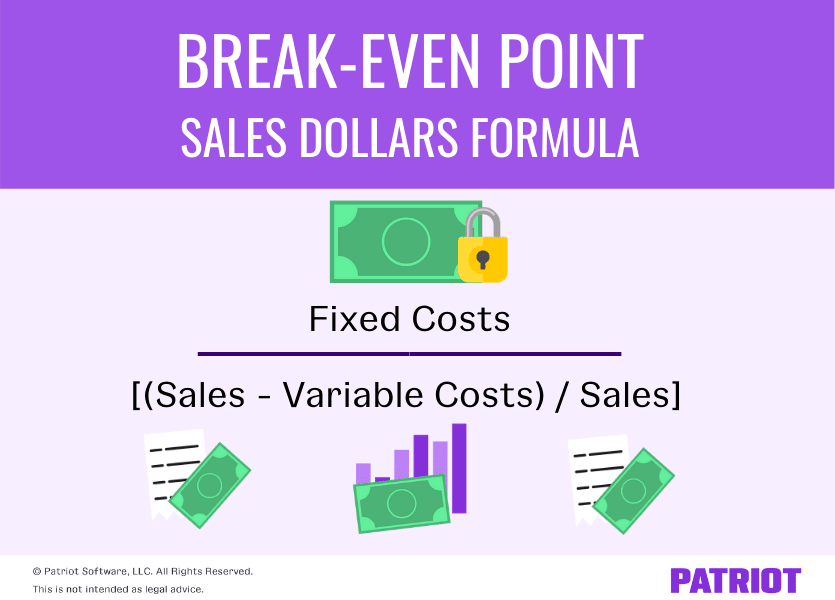

In investing, the breakeven point is the point at which the original cost equals the market price. Meanwhile, the breakeven point in options trading occurs when the market price of an underlying asset reaches the level at which a buyer will not incur a loss. In corporate accounting, the breakeven point (BEP) is the moment a company’s operations stop being unprofitable and starts to earn a profit. The breakeven point is the production level at which total revenues for a product equal total expenses. The breakeven point can also be used in other ways across finance such as in trading.

See profit at a glance

Efficient staffing and scheduling can help manage labor costs, potentially lowering the break-even point. Larger grocery stores may benefit from bulk purchasing and more efficient operations, leading to cost savings. Optimizing inventory turnover ensures that capital is not tied up in unsold goods, improving profitability. Break-even analysis is an important way to help calculate the risks involved in your endeavor and determine whether they’re worthwhile before you invest in the process. The break-even point is an extremely important starting goal to work towards.

- Your business needs to generate $250,000 in revenue to cover all operating expenses and break even.

- For instance, if shipping costs rise due to global supply chain problems, your variable costs might go up and can throw off your original calculation.

- Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

- Recall, fixed costs are independent of the sales volume for the given period, and include costs such as the monthly rent, the base employee salaries, and insurance.

What is your current financial priority?

Variable expenses in a grocery store usually account for between 40% and 60% of total expenses. Higher fixed expenses mean a higher break-even point, requiring more revenue to cover these costs. Fixed expenses, such as rent and salaries, remain constant regardless of sales volume, directly affecting the break-even point. Our business plan for a grocery store will help you succeed in your project.

How to Calculate Break Even Point in Units

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies approve and authorize an expense claim in xero for an exemption or exclusion from registration requirements. The break-even point or cost-volume-profit relationship can also be examined using graphs.

Contact us today to discover what QuickBooks can do to help you with all of your small business accounting needs. By raising your sales price, you’re in turn raising the contribution price of each unit and lowering the number of units needed to break even. With less units to sell, you lower that financial risk and instantly boost your cash flow.

Explore Square and our products

This margin is crucial for covering both fixed and variable expenses and achieving profitability. It’s important to study the feasibility of any project or new product line that you’re planning to launch. With break-even analysis, you can identify the time and price at which your business will turn profitable. This helps you plan the range of activities you need to reach that point, set up a turnaround time for your tasks, and stick to a timeline.

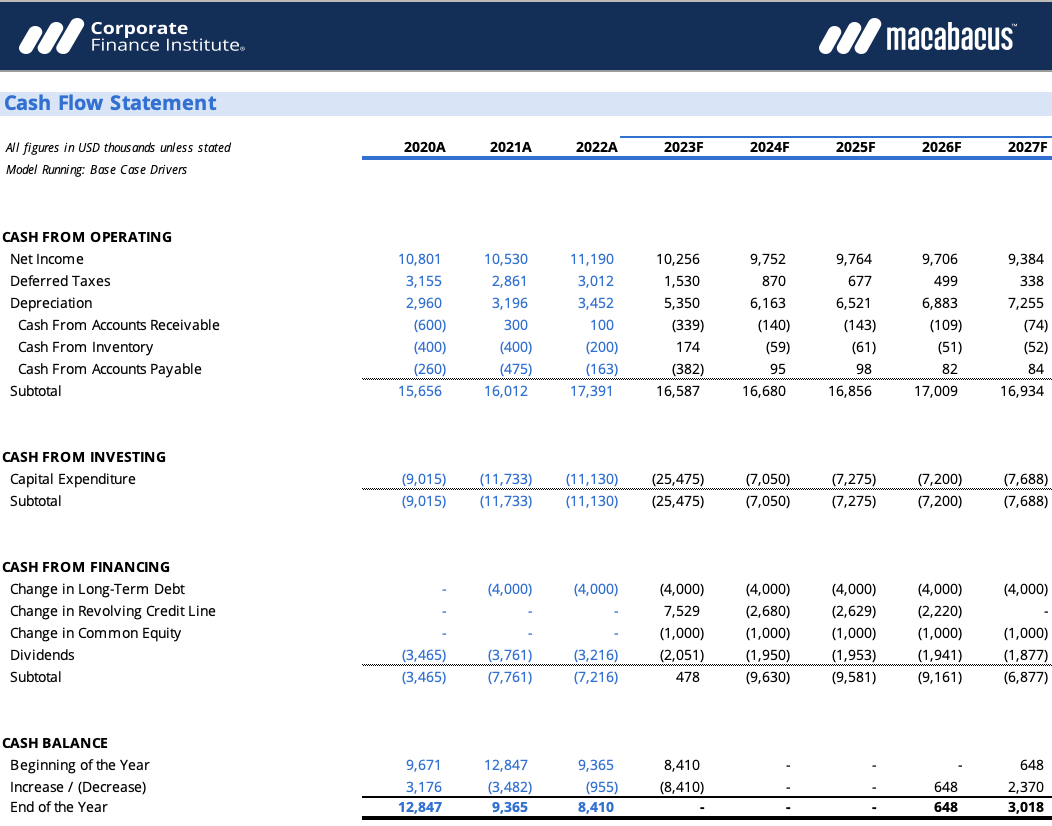

If customer demand and sales are higher for the company in a certain period, its variable costs will also move in the same direction and increase (and vice versa). The formula for calculating the break-even point (BEP) involves taking the total fixed costs and dividing the amount by the contribution margin per unit. A breakeven point is used in multiple areas of business and finance. In accounting terms, it refers to the production level at which total production revenue equals total production costs.

According to this formula, your break-even point will be $200,000 in sales revenue. This analysis shows that any money generated over $200,000 will be net profit. The answer to the equation will tell you how many units (meaning individual products) you need to sell to match your expenses. Doing an analysis helps determine what pricing and spending decisions make the most sense for a business so that they make sufficient profit — all by simply determining the break-even point. So Toby’s Sporting Goods has to sell 500 tennis rackets every month to break even. After you learn what the break-even point is, revisit the company’s revenue targets to ensure they’re making a profit.

Existing businesses should conduct this analysis before launching a new product or service to determine whether or not the potential profit is worth the startup costs. This computes the total number of units that must be sold in order for the company to generate enough revenues to cover all of its expenses. Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0. The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs.