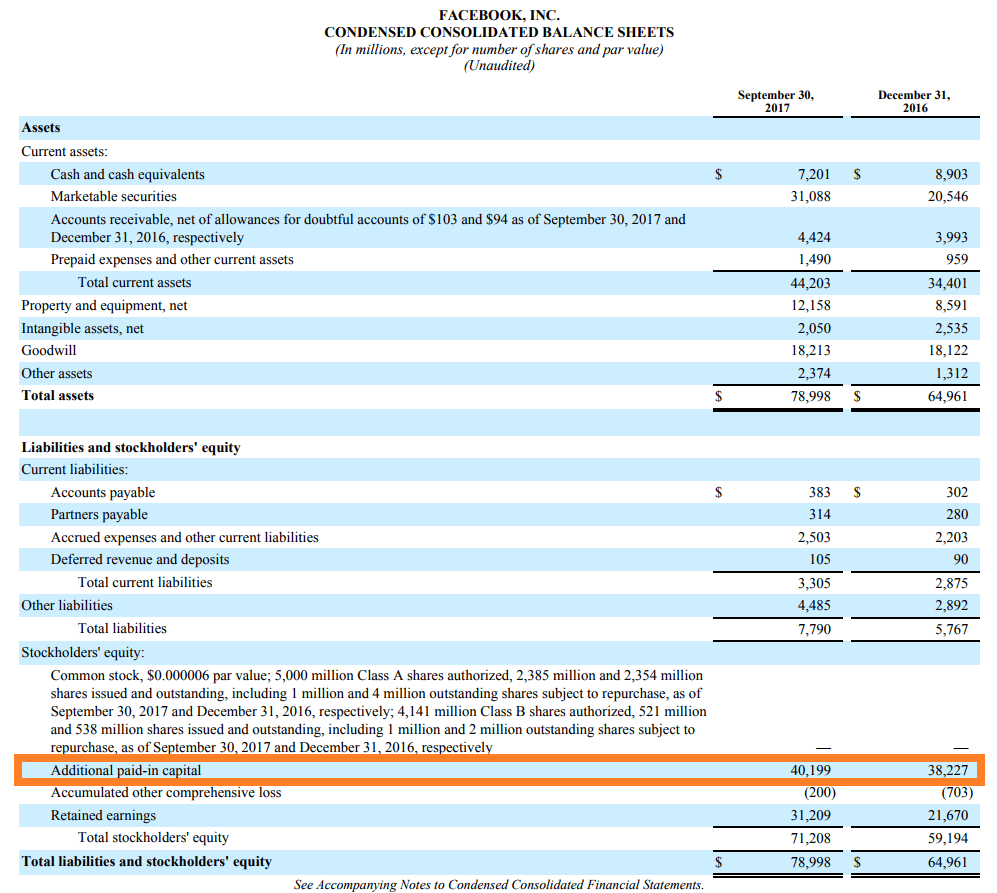

The company then credits the common or preferred stock account for the par value. The company then credits the additional paid-in capital or paid-in capital in excess of par, for money that was paid for the stock in excess of par. For common stock, paid-in capital, also referred to as contributed capital, consists of a stock’s par value plus any amount paid in excess of par value.

How Liam Passed His CPA Exams by Tweaking His Study Process

- According to the report, the World Bank must receive funds to finance the related annual spending worth $3 trillion by 2030.

- Capital that is contributed by investors, both potential investors and stock, is referred to as “Paid in Capital”.

- The retirement of treasury stock reduces the balance of paid-in capital, applicable to the number of retired treasury shares.

- When the buyers buy the shares from the open market, then the amount of shares is directly received by the investor selling them.

Some states require that you assign a book value, also known as the par value, to your preferred and common stock. The number of shares that were authorized and issued is listed after each type of stock. For example, the accounting entry for common stock listed in the paid-in capital account would be shown as common stock, $1 par value, 2,000 shares authorized, 100 shares issued.

The Ultimate Guide To Construction Accounting

Paid-In Capital, or “Contributed Capital”, measures the funds raised via stock issuances, where shares are exchanged to investors for partial ownership in the issuer’s equity. After the IPO, none of the daily stock movements will have an impact on the additional paid-in capital number in this example. This is because those trades do not generate any capital for the company, and therefore they have no impact on the company’s balance sheet. Only the shares sold by the company to raise capital should be included in the calculation.

FAR CPA Practice Questions: Capital Account Activity in Pass-through Entities

All subsequent stock issuances are then included in the three paid-in capital accounts. Additional paid-in capital is the difference between a share’s printed value and the amount the share is sold on the market. This often leads to companies trying to avoid this by setting their stock par values far lower than their actual worth. Companies only receive money from the proceeds of sales conducted in the primary market, generally selling in individually arranged deals to large institutional investors. When it receives stock sale proceeds, the company debits its cash account and credits its common stock or preferred stock account. Paid-in capital, or contributed capital, is the full amount of cash or other assets that shareholders have given a company in exchange for stock.

What Is Market Value?

Preferred shares sometimes have par values that are more than marginal, but most common shares today have par values of just a few pennies. Because of this, “additional paid-in capital” tends to be essentially representative of the total paid-in capital figure and is sometimes shown by itself on the balance sheet. A stock’s par value is the value that a company sets within its charter for one common share. And when you multiply this value by all the shares a company issues, you will get the minimum capital it can raise through that issuance.

Paid-in capital includes the par value of both common and preferred stock plus any amount paid in excess. McDonald’s total paid-in capital consists of $16.6 million in common stock par value plus paid in capital in excess of par additional paid-in capital of $60.235 billion. You can also see that McDonald’s retained earnings far exceeds its paid-in capital — which you’d expect given the fast-food chain’s long history.

When a public company wants to raise money, it may issue a round of common stock shares. It sells all of those shares to the public at par plus whatever value the market puts on it. From then on, the shares fluctuate in value as sellers and buyers determine their value in the open market. Par Value or Stated Value is essentially the “Face Value” or the initial offering price of a share of stock (whether for a public or privately held company). Paid-in capital is anything the company receives from stockholders for the sale of stock above and beyond the par value, i.e. in excess of Par. And also suppose it also had a paid-in capital in excess of par value of $2,500,000 for preferred stock and $5,000,000 for common stock.

For example, if a company has 1,000 shares outstanding with a par value of $10, the capital stock would be $10,000. Another common reason to keep excess capital is to have funds available for opportunity. By keeping cash on hand, an investor is more likely to be able to take advantage of opportunities as they arise, rather than having to sell other investments to raise the necessary funds. There are a number of reasons why an investor may choose to keep excess capital, but one of the most common is to diversify one’s portfolio. By investing only a portion of available funds, an investor can diversify their holdings and reduce their risk.