An increasing A/P turnover ratio indicates that a company is paying off suppliers at a faster rate than in previous periods, which also means that the number of days payables are outstanding is less. SaaS companies can find the right balance by tracking their accounts payable turnover ratio carefully with effective financial reporting. Analyzing the following SaaS finance metrics and financial statements will help you convey the financial and operational help of your business so partners can be proactive about necessary changes. The AP turnover ratio provides valuable insights into a company’s payment management efficiency and financial health.

Accounts Payable Turnover Ratio: What It Is, How To Calculate and Improve It

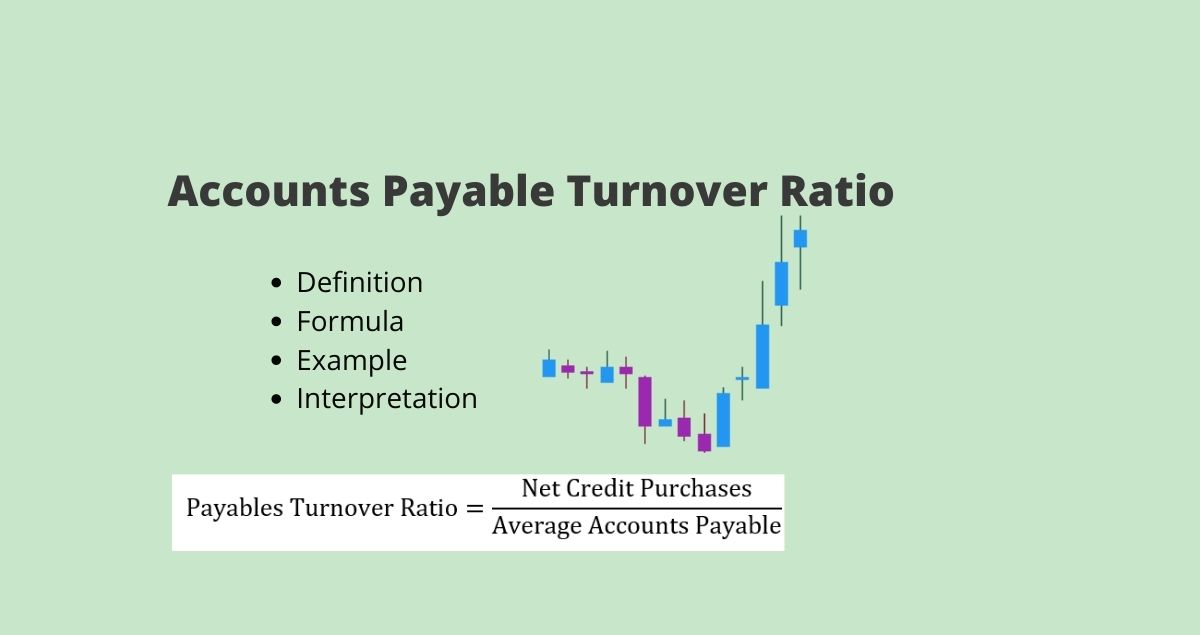

Once you have obtained your total supplier purchases and calculated the average accounts payable, you have all you need to calculate the accounts payable turnover ratio. The accounts payable turnover ratio is one such liquidity metric that can help you track how fast your business is able to pay its suppliers back, over a specific period of time. Businesses can track their accounts payable turnover ratios during each accounting period without having to gather additional information. Using the abovementioned formulas, here is an example of how to calculate your accounts payable turnover ratio.

Total supplier purchases identification

And use Mosaic’s income statement dashboard to proactively monitor your AP turnover by summarizing your revenue and expenses during a certain period of time. You’ll see whether the business generates enough revenue to pay off debt in a timely manner. To get the most information out of your AP turnover ratio, complete a full financial analysis. You’ll see how your AP turnover ratio impacts other metrics in the business, and vice versa, giving you a clear picture of the business’s financial condition. Measures how efficiently a company collects payments from its customers by comparing total credit sales to average accounts receivable. By calculating the AP turnover ratio regularly, you can gain insights into your payment management efficiency and make informed decisions to optimize your accounts payable process.

Seasonal Businesses Impact

When assessing your turnover ratio, keep in mind that a “normal” turnover ratio varies by industry. Alternatively, a lower ratio could also show you’ve been able to negotiate favourable payment terms — a positive situation for your company. That, in turn, may motivate them to look more closely at whether Company B has been managing its cash flow as effectively as possible. Transparency and visibility can help you catch cases of overpayment, redundant expenditures, obsolete purchases, and other such AP shortcomings. Knowing where your money goes and what it is being used for is a must-do for efficient business management.

- On a company’s balance sheet, the accounts payable turnover ratio is a key indicator of its liquidity and how it is managing cash flow.

- To improve your AP turnover ratio, it’s important to know where your current ratio falls within SaaS benchmarks.

- The formula for calculating the accounts payable turnover ratio divides the supplier credit purchases by the average accounts payable.

Solely relying on the AP Turnover Ratio for financial assessment can be misleading. It should be viewed in conjunction with other financial metrics like cash flow, liquidity ratios, and profitability measures. This holistic approach ensures a more balanced understanding of a company’s financial health.

Additionally, a low ratio might suggest that the company is missing out on early payment discounts, which could lead to higher operational costs. How does the accounts payable turnover ratio relate to optimizing cash flow management, external financing, and pursuing justified growth opportunities requiring cash? In corporate finance, you can add immense value by monitoring and analyzing the accounts payable turnover ratio. Transform the payables ratio into days payable outstanding (DPO) to see the results from a different viewpoint. Accounts payable and accounts receivable turnover ratios are similar calculations.

Accounts free online bookkeeping course and training is a crucial financial metric that measures the efficiency with which a company is managing its accounts payable. It is a financial ratio that helps in the analysis and evaluation of creditor payment policies and procedures. In simple terms, the Accounts Payable Turnover Ratio indicates the number of times a company pays its suppliers, vendors, and other creditors during a specific period. The AP turnover ratio is unique in that businesses want to show they can pay their bills on time, but they also want to show they can use their investments wisely.

The days payable outstanding (DPO) metric is closely related to the accounts payable turnover ratio. A ratio below six indicates that a business is not generating enough revenue to pay its suppliers in an appropriate time frame. Bear in mind, that industries operate differently, and therefore they’ll have different overall AP turnover ratios. Generally, a higher AP turnover ratio and a lower AR turnover ratio are seen as favorable. High AP turnover could indicate an overly aggressive payment policy that might strain supplier relationships, while a low AR turnover could signal ineffective credit management.

Determine whether your cash flow management policies and financing allow your company to pursue growth opportunities when justified. Over time, your business can respond to new business opportunities and changing economic conditions. Improve cash flow management and forecast your business financing needs to achieve the optimal accounts payable turnover ratio. After performing accounts payable turnover ratio analysis and viewing historical trend metrics, you’ll gain insights and optimize financial flexibility.

This article will deconstruct the accounts payable turnover ratio, how to calculate it — and what it means for your business. As with all financial ratios, it’s useful to compare a company’s AP turnover ratio with companies in the same industry. That can help investors determine how capable one company is at paying its bills compared to others. Accounts payable is short-term debt that a company owes to its suppliers and creditors. The accounts payable turnover ratio can reveal how efficient a company is at paying what it owes in the course of a year. To optimize the AP turnover ratio, companies can leverage technology and AP automation to improve the efficiency of their accounts payable processes.

This KPI can indicate a company’s ability to manage cash flow well and then pay off its accounts in a timely manner. AP turnover typically measures short-term liquidity and financial obligations, but when viewed over a longer period of time it can give valuable insight into the financial condition of the business. A high AP turnover ratio typically reflects positively on a company’s financial health.