For instance, it has been the traditional practice to absorb overheads based on a single base. For instance, a business with a labor incentive environment absorbs the overhead cost with the labor hours. On the other hand, the business with the machine incentive environment absorbs overhead based on the machine hours. A predetermined overhead rate is used by businesses to absorb the indirect cost in the cost card of the business. Further, this rate is calculated by dividing budgeted overheads by the budgeted level of activity. Accurately calculating overhead rates is important for determining the full cost of a product and appropriately pricing goods and services.

What is the formula for overhead in cost accounting?

As previously mentioned, the predetermined overhead rate is a way of estimating the costs that will be incurred throughout the manufacturing process. That means it represents an estimate of the costs of producing a product or carrying out a job. The estimate will be made at the beginning of an accounting period, before any work has actually taken place. The formula for a predetermined overhead rate is expressed as a ratio of the estimated amount of manufacturing overhead to be incurred in a period to the estimated activity base for the period. The company, having calculated its overhead costs as $20 per labor hour, now has a baseline cost-per-hour figure that it can use to appropriately charge its customers for labor and earn a profit. That is, the company is now aware that a 5-hour job, for instance, will have an estimated overhead cost of $100.

Step 2 of 3

For instance, cleaning and maintenance expenses will be absorbed on the basis of the square feet as shown in the table above. If the absorbed cost is more than the actual cost, an adjusting entry is passed to reduce the expenses. On the other hand, if the actual cost is more, an adjusting entry is passed to record the remaining cost in the business’s income statement. This option is best if you have some idea of your costs but don’t have exact numbers. This information can help you make decisions about where to cut costs or how to allocate your resources more efficiently.

Materials Cost Example

Hence, this predetermined overhead rate of 66.47 shall be applied to the pricing of the new product VXM. Two companies, ABC company, and XYZ company are competing to get a massive order that will make them much how to calculate predetermined overhead rate recognized in the market. This project is going to be lucrative for both companies but after going over the terms and conditions of the bidding, it is stated that the bid would be based on the overhead rate.

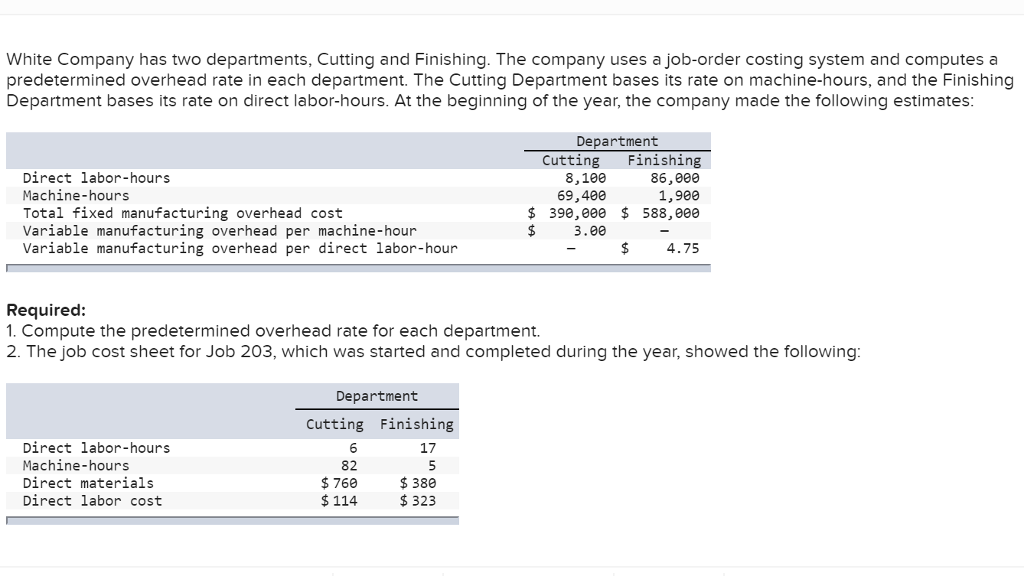

As a result, the overhead costs that will be incurred in the actual production process will differ from this estimate. The activity base (also known as the allocation base or activity driver) in the formula for predetermined overhead rate is often direct labor costs, direct labor hours, or machine hours. The activity base can differ depending on the nature of the costs involved. That is, a number of possible allocation bases such as direct labor hours, direct labor dollars, or machine hours can be used for the denominator of the predetermined overhead rate equation. If the predetermined overhead rate is overapplied or underapplied, the potential product demand may be miscalculated as well.

- Ahead of discussing how to calculate predetermined overhead rate, let’s define it.

- Sourcetable is the optimal tool for anyone looking to enhance their efficiency and accuracy in financial analysis or academic learning.

- This rate, calculated as total estimated overhead costs / total estimated allocation base, helps businesses in allocating overhead costs more precisely.

- Conversely, the cost of the t-shirts themselves would not be considered overhead because it’s directly linked to your product (and obviously changes based on the volume of products you create and sell).

The period selected tends to be one year, and you can use direct labor costs, hours, machine hours or prime cost as the allocation base. In larger companies, each department in which different production processes take place usually computes its own predetermined overhead rate. Take, for instance, a manufacturing company that produces gadgets; the production process of the gadgets would require raw material inputs and direct labor.

With $2.00 of overhead per direct hour, the Solo product is estimated to have $700,000 of overhead applied. When the $700,000 of overhead applied is divided by the estimated production of 140,000 units of the Solo product, the estimated overhead per product for the Solo product is $5.00 per unit. The computation of the overhead cost per unit for all of the products is shown in Figure 6.4. The rate is determined by dividing the fixed overhead cost by the estimated number of direct labor hours. The predetermined overhead rate was found by dividing the estimated manufacturing overhead cost by the estimated total units in the allocation base, so the predetermined overhead cost per unit is $9.00.

Overhead rates refer to the allocation of indirect costs to the production of goods or services. They represent a percentage or rate that is applied to an appropriate cost driver, such as labor hours or machine hours, to assign overhead costs to products. For example, assume a company expects its total manufacturing costs to amount to $400,000 in the coming period and the company expects the staff to work a total of 20,000 direct labor hours. In order to calculate the predetermined overhead rate for the coming period, the total manufacturing costs of $400,000 is divided by the estimated 20,000 direct labor hours. The overhead rate is calculated by dividing total overhead costs by an appropriate allocation measure such as direct labor hours.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.