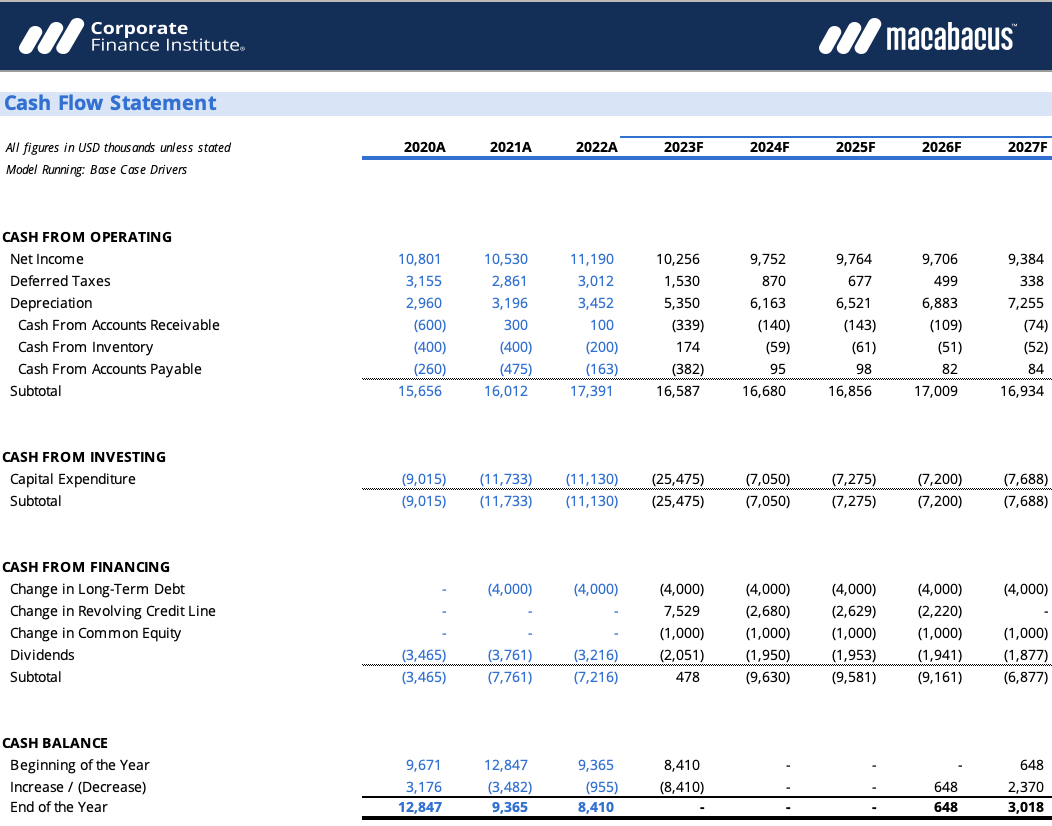

A cash flow statement is a financial statement that shows the cash going in and out of a business over a set period. A company’s accounting department keeps track of every transaction that involves cash, such as receiving money when a client pays an invoice or sending money out to make payroll or meet a loan payment. Businesses take in money from sales as revenues (inflow) and spend money on expenses (outflow). They may also receive income from interest, investments, royalties, and licensing agreements and sell products on credit rather than for immediate cash. Assessing cash flows is essential for evaluating a company’s liquidity, flexibility, and overall financial performance.

Free Course: Understanding Financial Statements

If you want to know more about cash flow statement, check out the Certificate Program in Financial Analysis, Valuation, & Risk Management offered by Hero Vired in collaboration with edX and Columbia University. Cash flow statements are one of the three fundamental financial statements financial leaders use. Along with income statements and balance sheets, cash flow statements provide crucial financial data that informs organizational decision-making.

What Does a Negative Cash Flow From Financing Mean?

Recall that comparing net income to operational cash flows can help assess the quality of earnings. In the next section you’ll explore operating cash flow and free cash flow to the firm, two key points of analysis in assessing cash flows. With the indirect method, cash flow is calculated by adjusting net income by adding or subtracting differences resulting from non-cash transactions.

Cash Flows From Operations (CFO)

A company’s understanding of its cash inflows and outflows is critical for meeting its short-term and long-term obligations to its suppliers, employees, and lenders. Current and potential lenders and investors are also interested in the company’s cash flows. Cash flow from operations (CFO) describes money flows involved directly with the production and sale of goods from ordinary operations. Also known as operating cash flow or OCF, as well as net cash from operating activities, CFO indicates whether or not a company has enough funds coming in to pay its bills or operating expenses.

- We begin with reasons why the statement of cash flows (SCF, cash flow statement) is a required financial statement.

- The price-to-cash flow (P/CF) ratio compares a stock’s price to its operating cash flow per share.

- Analyzing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether a company may be on the brink of bankruptcy or success.

- Cash flow statements are one of the most critical financial documents that an organization prepares, offering valuable insight into the health of the business.

A cash flow statement (CFS) is a financial statement primarily intended to provide information about the cash receipts and cash payments of a business during the period of time covered by the income statement. While a statement of cash flows shows money going in and out of the company over a period of time, the balance sheet gives a snapshot of the company’s financial standing at a point in time. turbotax super bowl commercial tv ad 2021 and #taxfacts However, how this information is presented depends on whether a company uses the “direct method” or “indirect method” for operating cash flows. Under the direct method, these cash inflows from customers and outflows to employees and suppliers are presented as such. Direct cash flow statements show the actual cash inflows and outflows from each operating, investing, and financing activity.

At the bottom of the SCF (and other financial statements) is a reference to inform the readers that the notes to the financial statements should be considered as part of the financial statements. The notes provide additional information such as disclosures of significant exchanges of items that did not involve cash, the amount paid for income taxes, and the amount paid for interest. Positive cash flows within the CFI section, which can be generated in such ways as selling equipment or property, can be considered good.

A large disparity between the amount of reported income and the net change in cash flows could indicate that there is fraud in the preparation of a company’s financial statements. The purpose of the statement of cash flows is to present cash inflows and outflows for a reporting period to the reader of the report. These inflows and outflows are further classified into operating, investing, and financing activities. The information is used by the investment community to discern the ability of an organization to generate cash, and how the funds are then used.

However, investors usually prefer that companies generate their cash flow primarily from business operations. Using this information, an investor might decide that a company with uneven cash flow is too risky to invest in; or they might decide that a company with positive cash flow is primed for growth. Cash flow might also impact internal decisions, such as budgeting, or the decision to hire (or fire) employees. Purchase of Equipment is recorded as a new $5,000 asset on our income statement. It’s an asset, not cash—so, with ($5,000) on the cash flow statement, we deduct $5,000 from cash on hand. Increase in Accounts Receivable is recorded as a $20,000 growth in accounts receivable on the income statement.

It’s important to remember that long-term, negative cash flow isn’t always a bad thing. For example, early stage businesses need to track their burn rate as they try to become profitable. So, even if you see income reported on your income statement, you may not have the cash from that income on hand. The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you have on hand for that time period. While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time.