This principle ensures that the price charged between related entities is the same as what would be charged between independent parties. For instance, a company may allocate rent costs based on the square footage occupied by each department. If the marketing department occupies 30% of the office space, it may be allocated 30% of the rent expense. Similarly, utilities may be allocated based on the number of employees or equipment used in each department. In the retail sector, cost structures are heavily influenced by inventory management and supply chain logistics. Retailers must carefully balance the costs of purchasing and storing inventory with the need to meet customer demand.

Step Four: Allocate Variable Costs Among Departments or Projects

From the perspective of the matching concept, (i.e., matching cost and benefits) it is logical to allocate a cost to the object (e.g., user, activity, department, product) basedon a “cause and effect” relationship. If the driver for a cost cannot beidentified, or identified easily, then an allocation scheme perceived to be “fair and equitable” might be used. A search for a “fair andequitable” allocation method often leads the system designer to the “ability to bear” the cost logic. Some examples that most readers canrelate to include allocating the costs of federal, state and local governments to their constituents. Federal and state income taxes are based on the”ability to bear” logic, i.e., they are progressive in that those with higher incomes pay a higher percentage of their incomes than those with lowerincomes. Whether either of these taxallocation schemes is also “fair and equitable” is subjective and therefore controversial.

- The details for a recent accounting period are provided in Exhibit 6-16.Joint cost allocations are presented in Exhibit 6-17 based on the four allocation methods discussed above.

- Making strategic decisions with sustainability implications in mind could increase costs in the short-term but prove beneficial and cost-saving in the long run.

- Cost allocation is a financial accounting process that involves assigning various costs incurred by a business to the specific activities or elements used or benefitted from incurring these costs.

- The right financial reporting software gives you instant visibility into your costs allowing you to put an accurate and efficient cost allocation plan in place.

Effortlessly streamline your business payments and collections

Unlike the step-down method, reciprocal allocation simultaneously allocates costs between all service departments, reflecting the true interdependencies. This method often employs linear algebra to solve the equations that represent these mutual services. For instance, in a university setting, the costs of the IT department and the library might be allocated to each other as well as to other departments.

Cost Allocation: The Key to Understanding Financial Efficiency

Sander den Hartog explains that transfer pricing is “a form of cost allocation” that must be handled carefully to ensure regulatory compliance. Incorrect allocation of costs in this context can result in hefty penalties or tax audits. A crucial principle in cost allocation is ensuring that costs are distributed based on the cause-and-effect relationship between the resource and the cost object. Pull allocations are particularly useful when the cost structure is volume-driven, meaning that costs are influenced by the level of activity. This method is mostly used by organizations that would like to get a good grip on the differences between actual costs and expected cost based upon volumes. For example, a manufacturing company may allocate labor costs based on the number of products produced by each department.

A disadvantage of using the dual rate method is that idle capacity costs for theservice departments are allocated to the user departments. This problem is eliminated by using the single budgeted rate method illustrated below. First stage allocations may include self services and reciprocal services between service departments, as well as services to producing departments. Self service refers to situationswhere service departments use some of their own service.

AccountingTools

This technique is often used for clear, identifiable expenses that don’t require complex calculations. Power and fuel costs management refers to the management of plant utilities as such costs are plant-related. These are often in terms of expenditures directly gambling winnings linked to the consumption of electric supply, gas or other fuel other than base building requirements assumed in the utility costs. Economic uncertainty and constraints are recurring challenges that State, Local, Tribal and Not-for-Profit organizations face.

Which type of overhead rates, plant wide, departmental or ABC are determined using a two stage cost allocation process? In the sections above, several comments were made in reference to the decision of whether to sell raw chicken or fried chicken. Following this decision rule, the joint costs arenot relevant because they will not be different regardless of the decision to sell at the split-off point or to process the products beyond this point. Thedecision should be based on a comparison of the additional market value created by further processing, with the additional cost required beyond the split-offpoint. Revised income statements are presented in Exhibit 6-19 to underscore this point.

The values added beyond the split-off point are $280,000 for productW and $160,000 for product D. (See the note under the table for these calculations.) These values do not change, regardless of the joint costallocation method, although the individual gross profit amounts vary widely across the four methods. Clearly, selling both white and dark fried chicken ismore profitable than selling either product at the point of separation. Since it is not clear how these allocations should be performed to obtain more accurate product costs, wewill examine three possible alternative methods.

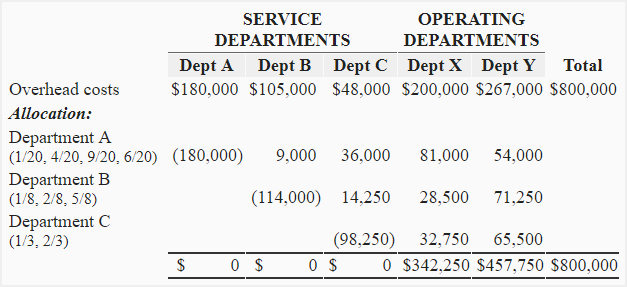

The direct method is generally more efficient compared to other complex cost allocation methods. Since it skips the step of allocating costs to intermediate cost pools, it saves time and resources. This efficiency is beneficial for businesses that need a quick and practical approach to allocating costs. The direct method of cost allocation is a technique used by businesses to assign costs directly to specific cost objects or activities.

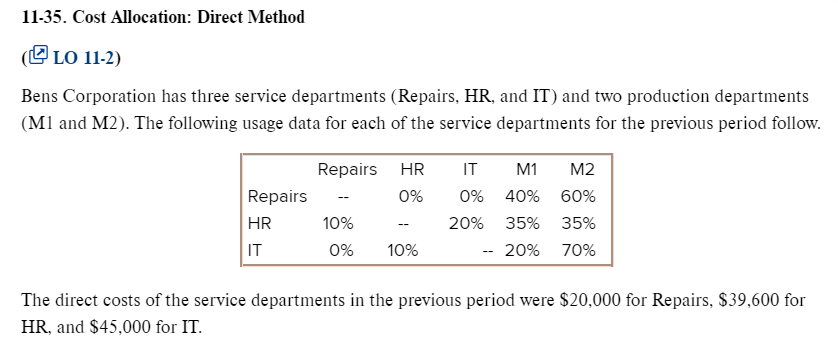

Operating costs span both categories and cover day-to-day business activities. They can be either fixed, like insurance premiums, or variable, like energy usage. The direct method allocates costs of each of the service departments to each operating department based on each department’s share of the allocation base. This means the direct method does not recognize service performed by other service departments. For example, if Service Department A uses some of Service Department B’s services, these services would be ignored in the cost allocation process. Because these services are not allocated to other service departments, some accountants believe the direct method is not accurate.