The ‘layer’ concept and ‘base-year’ concept are inherent parts of Dollar Value LIFO. So, under the Dollar-Value LIFO method, your inventory at the end of 2022 would be valued at $1,360. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

Lower ending inventory values mean that the total assets reported will be lower. This can affect key financial ratios such as the current ratio and the quick ratio, which are used to assess a company’s liquidity. Investors and analysts often scrutinize these ratios to gauge the financial health of a business. Therefore, companies using Dollar-Value LIFO need to be prepared to explain these differences to stakeholders. Once you grasp these processes, you can significantly simplify the Dollar Value LIFO analysis, making it a go-to choice for inventory management in various business circumstances.

Advantages and Disadvantages of Dollar Value LIFO Inventory

This accounting approach aligns the increased costs of recent inventory acquisitions with the revenue generated in the same period. As a result, the company reports a higher cost of goods sold (COGS) and, consequently, lower profits. Weighted Average Cost is another method that provides a middle ground between FIFO and LIFO.

Dollar Value LIFO – Key takeaways

Under this method, it is possible to use a single pool but a company can use any number of pools according to its requirement. The unnecessary employment of a large number of reorder level of stock explanation formula example pools may, however, increase cost and also reduce the effectiveness of dollar-value LIFO approach. Companies that utilization the dollar-value LIFO method are those that both keep a large number of products, and expect that product mix to change substantially from now on.

To arrive at the cost of the Year 2 LIFO layer, Entwhistle’s controller multiplies the 1,500 units by the base year cost of $15.00 and again by the 110% index to arrive at a layer cost of $24,750. In total, at the end of Year 2, Entwhistle has a base layer cost of $15,000 and a Year 2 layer cost of $24,750, for a total inventory valuation of $39,750. However, it is not clear whether the company actually has more inventory or if it simply paid more and the actual quantity in ending inventory is the same or less than beginning inventory. To determine the correct $value LIFO ending inventory and cost of goods sold, qunatity increases must be separated from price increases. This example also makes it explicit that the Dollar Value LIFO method isn’t just about the physical quantity of the inventory.

- Each layer represents the increase or decrease in inventory value from one year to the next.

- They can create inventory pools by categorising their products based on certain variables like car type, model, or year.

- However, remember, the chosen base year doesn’t influence the dollar value of the inventory; it’s only a point of reference.

- When converting from LIFO inventory to dollar value LIFO, a price index is used to adjust the inventory value.

- This method helps in matching current costs with current revenues in the income statement.

However, this also means higher tax liabilities, as the lower COGS increases taxable income. Dollar-value LIFO uses this approach with all figures in dollar amounts, rather than in inventory units. It provides a different view of the balance sheet than other accounting methods such as first-in-first-out (FIFO).

Another prominent example is the automobile industry, where producers regularly update their vehicle models. They can create inventory pools by categorising their products based on certain variables like car type, model, or year. The Dollar Value LIFO formula can then be used to calculate the inventory layers for each category. Any organisation with a multi-item inventory facing inflation can make use of this formula. The fashion and apparel industry is a fine example where the Dollar Value LIFO formula can be applied. This industry typically deals with an extensive mix of products, with evolving designs each season, making the Dollar Value LIFO method an ideal approach to inventory valuation.

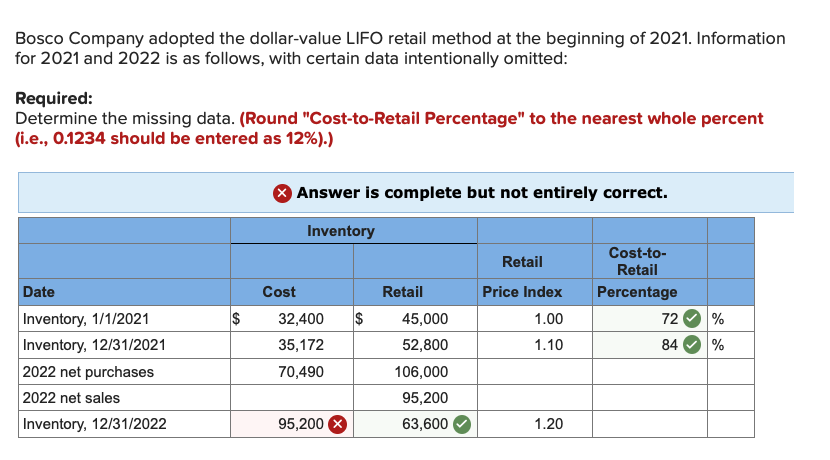

If you choose LIFO, you can further select from one of several submethods, including dollar-value LIFO, or DVL. When the adjusted ending inventory exceeds the beginning inventory, it indicates additional purchases, and a new layer is created for the amount of the increase. Choose a base year for the Dollar Value LIFO method, as it’s the year to which you will compare all subsequent years. You will use the prices in this year as a base to interpret changes in the value of the inventory.

Instead of tracking individual items, Dollar-Value LIFO tracks the total value of the inventory. Instead, you consider your inventory as a quantity of value consisting of annual layers. You don’t base your ending inventory value on the count of items, but rather on the dollar value of those items. In 2022, the price of the items increases to $12 each due to inflation, and you purchase 50 additional units.

Record the ending inventory at the end of each subsequent year based on the prices existing at that time. You will compare this ending inventory with the prior year’s inventory to calculate any changes in the dollar value. Understanding Dollar Value LIFO is crucial for Business Studies because it provides a realistic view of inventory management and cost of goods calculation. Dive headfirst into the world of business studies with a comprehensive look at the Dollar Value LIFO concept. Understanding Dollar Value LIFO, its key components, and its relevance within the field of business is vital for any budding trade professional. This guide offers an in-depth view of Dollar Value LIFO inventory, including its advantages, disadvantages, and components to consider.